are assisted living expenses tax deductible in 2019

Which means a doctor or nurse with. Yes assisted living expenses are tax-deductible.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

In order for assisted.

. Conditions to Be Met for Senior Living Medical Expenses to Be Tax-Deductible. Health fees from overseas can only be tax deductible if they are from a public university or public hospital. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019.

Your emergency fund can help you as you adjust to your budget. Common Health Medical Tax Deductions For Seniors. The breakdown must clearly show the amounts paid for staff salaries that apply to the attendant care services listed under Salaries and wages Expenses you can claim.

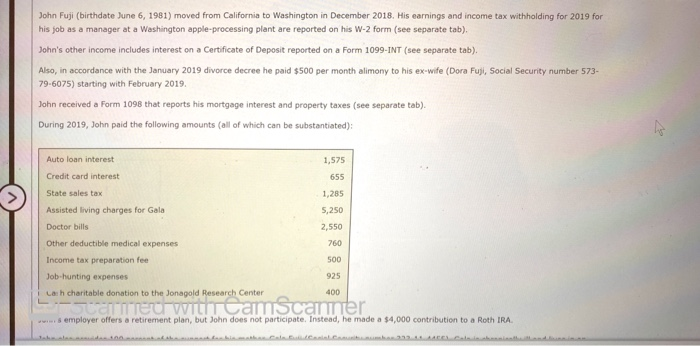

What Portion Of Assisted Living Is Tax Deductible. Some senior living expenses including medical expenses and assisted living expenses are tax-deductible within certain parameters. Answer Yes in certain instances nursing home expenses are deductible medical expenses.

Chronic Illness and Tax Deductible Status. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. If you are for example an adult child of someone in assisted living and you are paying for your loved ones care you will be able to deduct the correct expenses from your tax.

As mentioned earlier medical expenses for senior living may be tax-deductible if specific. The Conditions That Determine if Assisted Living Can Become Tax Deductible Different medical expenses can be tax deductible. Solution found If you or your loved one lives in an assisted living community part or all of your assisted living costs may.

The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction. Its important to note that each financial situation is. Contact the facility and request a.

If you your spouse or your dependent is in a nursing home primarily for. Often times the assisted living facility can provide a breakdown of which fees are considered eligible for medical deductions. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill.

And yes even the medical expenses that do. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019. In order for assisted living expenses to be tax deductible.

Tax Deductibility Of Assisted Living Senior Living Residences

Tax Deductibility Of Assisted Living Senior Living Residences

John Fuji Birthdate June 6 1981 Moved From Chegg Com

How To Pay For Nursing Homes Assisted Living

Tax Deductibility Of Life Insurance What To Know 2022

Can I Get Tax Deductions From Assisted Living Expenses

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Dependent Tax Deductions And Credits Tax Exemptions Deductions And Credits For Families Turbotax Tax Tips Videos

How To Deduct Home Care Expenses On My Taxes

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

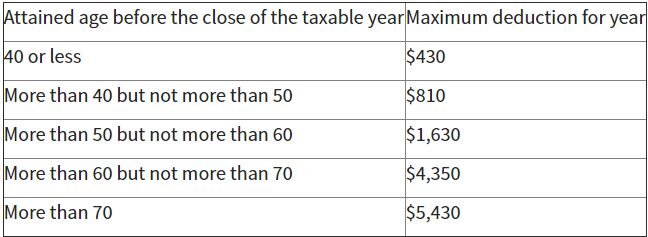

Irs Issues Long Term Care Premium Deductibility Limits For 2020 Pierrolaw

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Articles What Tax Deductions Are Available For Assisted Living Expenses Seniors Blue Book

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Can I Claim Medical Expenses On My Taxes H R Block

Self Employed Health Insurance Deductions H R Block

Common Health Medical Tax Deductions For Seniors In 2022

![]()

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc