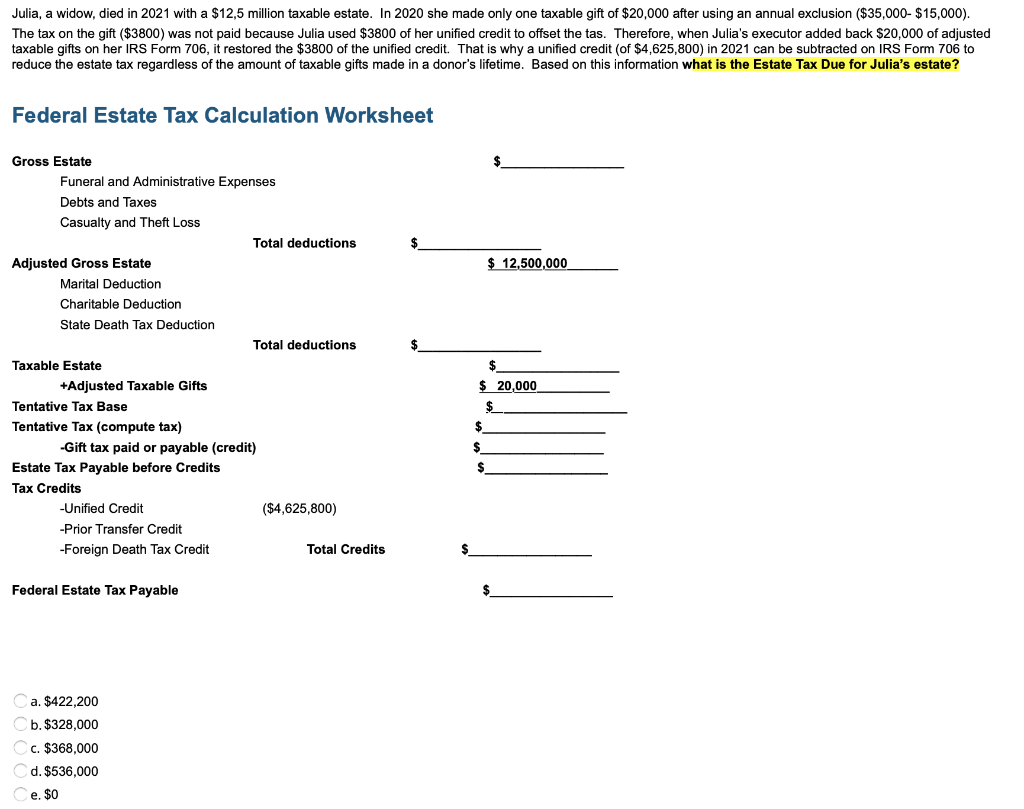

unified estate tax credit 2021

Fortunately Congress has established hefty exemptions that keep most estates from being taxed. Any tax due is.

Gift Tax Does This Exist At The State Level In New York

Is added to this number and the tax is computed.

. What Is Unified Credit for 2021. What Is the Unified Tax Credit Amount for 2021. It will then be taken as a.

Click here for schedules and for detailed information Grass coupon credits can be. 15000 per person per person. Any tax due is.

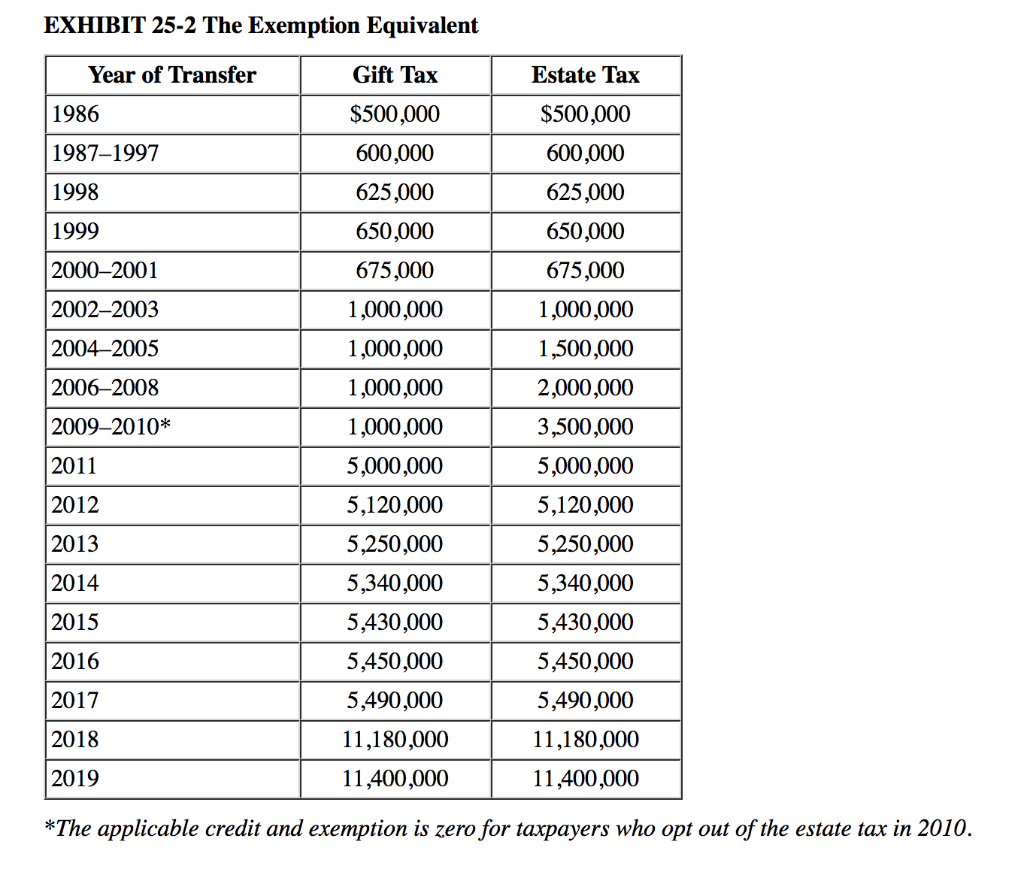

Are worth more than these exemption thresholds. Or of course you can use the unified tax credit to do a little bit of both. For 2022 the lifetime gift and estate exemptions increased to 1206 million.

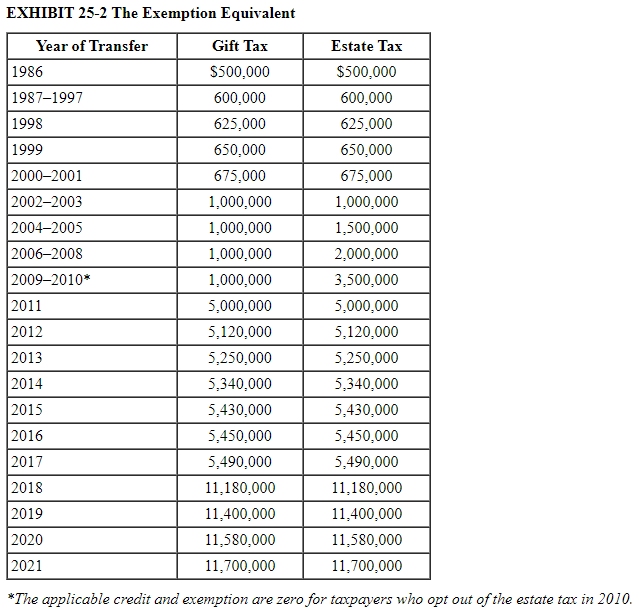

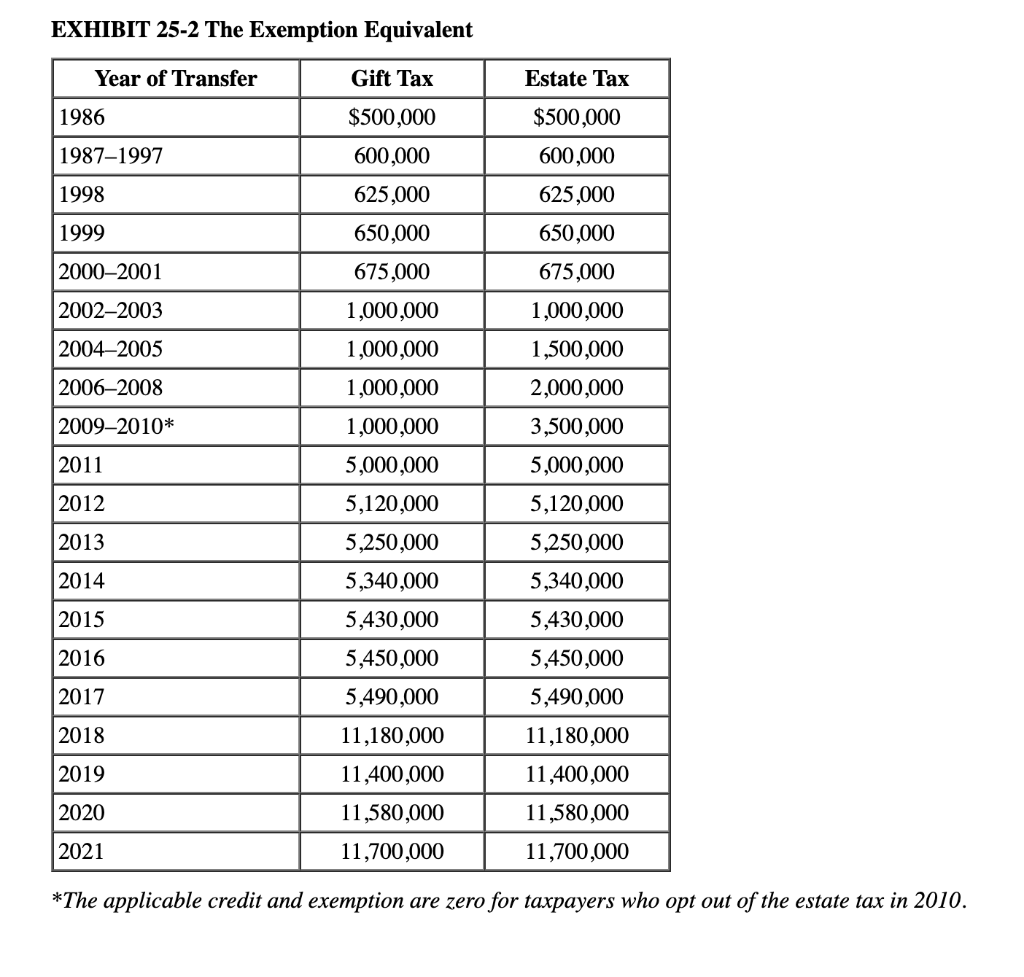

Property Tax DeductionCredit Eligibility. The 2021 federal tax law applies the estate tax to any amount above 117 million. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

Indicate whether you live in a home that you owned choose Homeowner or rented choose Tenant during 2021. What Is the Unified Tax Credit Amount for 2022. The Recycling and Solid Waste Division provides the following services.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Which will then be subtracted from unified credit unless the gift tax is paid in the year it is incurred.

For those that are federal estate tax rates apply to any amount above the exemption thresholds. Get information on how the estate tax may apply to your taxable estate at your death. You are eligible for a property tax deduction or a property tax credit only if.

Wondering what tax credits you can claim on your Indiana individual income tax return. 5 You can give up to this amount in money or. Only a small percentage of estates in the US.

Unified Estate And Gift Tax. Youre able to give 15000 to up to 10 different people for a total of 150000 going out of your accounts without the need to. The tax is then reduced by the available unified credit.

The Internal Revenue Service announced today the official estate and gift tax limits for 2021. The previous limit for 2020 was 1158 million. The unified tax credit changes regularly depending on.

You can find all available credits listed below including a brief description which forms and schedules. The previous limit for 2020 was 1158 million. The deadline for filing the 2021 Senior Freeze Property Tax Reimbursement program PTR is October 31st 2022.

If you were both a. Forms can be completed between the hours of 9-12 Tuesday Wednesday. For 2021 the annual exclusion for gifts is 15000.

If a tax on a gift has been paid under chapter 12 sec. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. For 2022 the federal estate tax maxes out at 40 See more.

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Julia A Widow Died In 2021 With A 12 5 Million Chegg Com

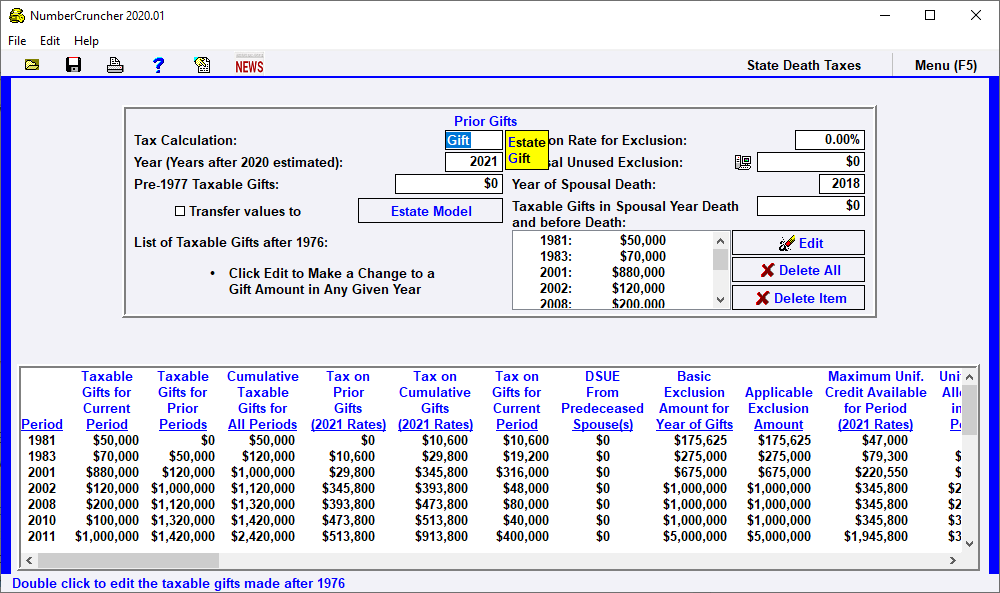

Prior Gifts Leimberg Leclair Lackner Inc

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Proposed Changes To The Federal Estate Gift Tax Exemption Brmm

Estate Tax Rate Schedule And Unified Credit Amounts Download Table

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver

2022 Estate Gift And Gst Tax Exemptions Announced By Irs Nixon Peabody Blog Nixon Peabody Llp

2020 New York Resident Estate Taxation Parisi Coan Saccocio Pllc

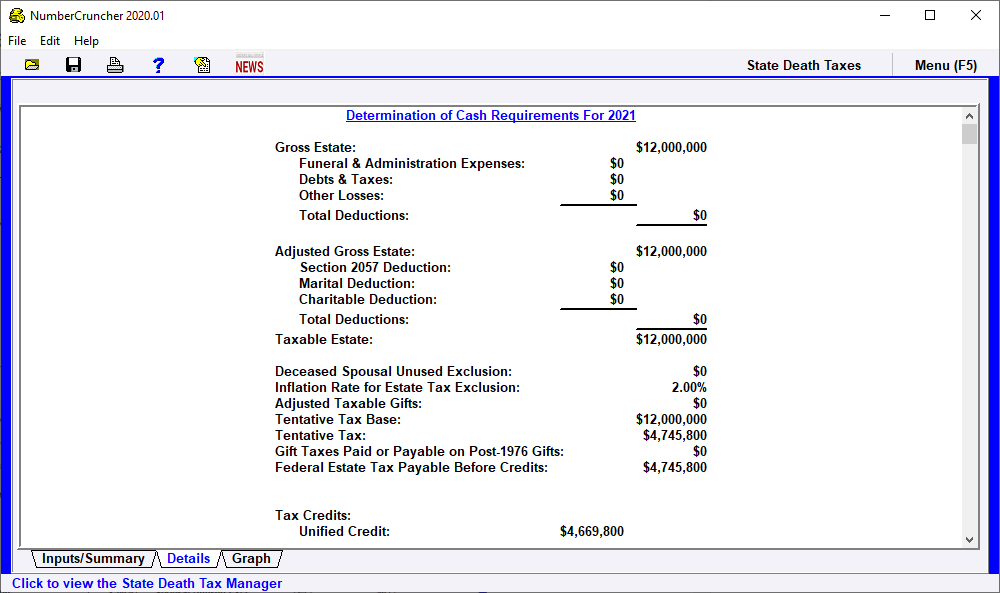

Cash Need Determination Of Cash Requirements Leimberg Leclair Lackner Inc

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

Solved For All Requirements Enter Your Answers In Dollars Chegg Com

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

New Tax Exemption Amounts 2022 Estate Planning Jah

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com